FORUM Credit Union Streamlines Loan Decisions with 99% Accuracy Using AgentFlow

99%

Document Classification Accuracy

99%

Data Extraction Precision

100%

Automated Decisioning

"Partnering with Multimodal has been a game-changer for our lending operations.”

Challenge

Solution

Results

THE PROBLEM

The Lending Bottleneck: Manual Processes Holding Back Growth

Auto lending is one of FORUM Credit Union’s most important business lines, but its loan processing has not kept pace with modern demands.

Each application required staff to manually review dozens of documents, extract borrower details, and make complex credit decisions across scanned, handwritten, and inconsistently formatted files.

This created major challenges. Loan officers faced backlogs during peak periods, delaying service for members. Errors in data entry introduced compliance risk in a tightly regulated environment. The labor-heavy workflow made scaling impossible, creating an unsustainable model as members demanded fast, digital-first experiences.

With digital banking rising and consumer expectations shifting, FORUM Credit Union needed a solution. Yet existing automation tools were too generic for real-world loan packages or too IT-heavy to empower business teams.

The team needed a smarter way to manage documentation at scale, reduce human error, and maintain audit readiness while integrating seamlessly with their primary platform, Temenos.

What they required was a platform that delivered accuracy, compliance, and speed without compromise.

THE SOLUTION

Reimagining Auto Loan Processing for Speed, Accuracy, and Trust

FORUM Credit Union partnered with us to implement an Agentic Automation solution that removed manual bottlenecks and transformed auto lending through AI-powered document intelligence, automated decisioning, and seamless system integration.

At the center was AgentFlow, which streamlined the entire process from document intake to final decision.

Two capabilities stood out:

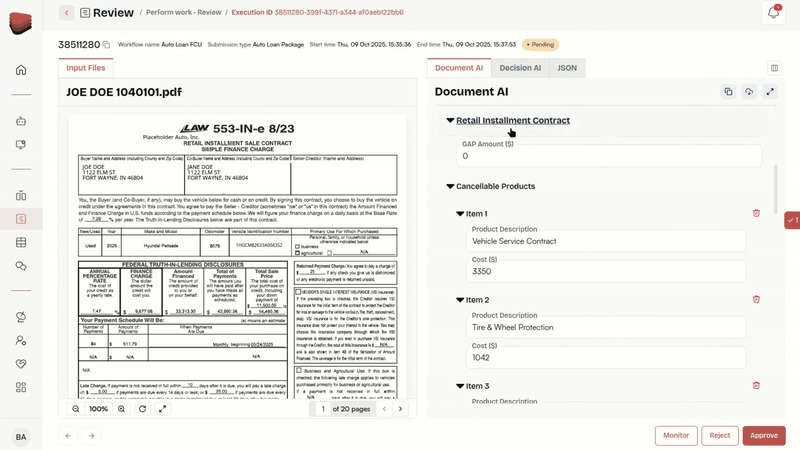

- Document AI handled the burden of sorting and extracting data from complex auto loan packages, including scanned and handwritten files. What once required hours of review could now be completed with precision in minutes.

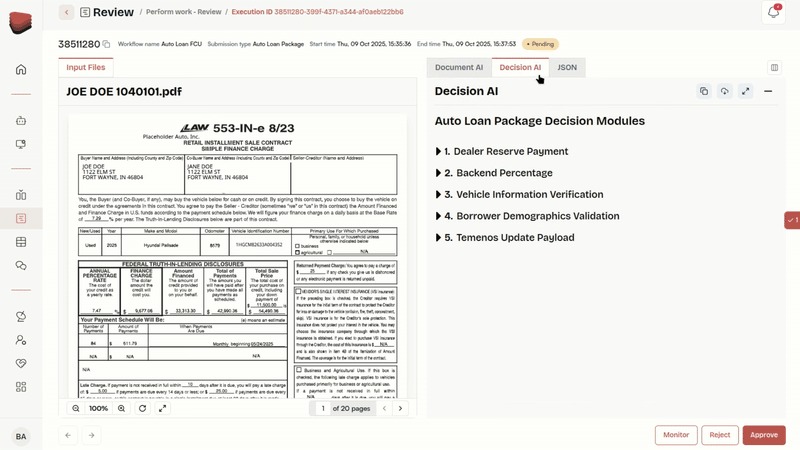

- Decision AI automated evaluations, such as credit calculations and payout values, while creating clear audit trails that met compliance requirements. Every decision was explainable and regulator-ready.

These capabilities were orchestrated within AgentFlow’s intuitive interface and integrated directly with Temenos, FORUM’s core system. We designed the solution alongside FORUM's lending team, incorporating human reviewers where necessary.

“Just as important, the platform integrates seamlessly with our Temenos core, giving us a straight-through process that is faster, more transparent, and audit-ready.” — Chris Ferguson, Senior Vice President Consumer Lending at FORUM Credit Union

THE RESULTS

Measurable Gains in Accuracy, Compliance, and Member Experience

The impact of the new platform was immediate. FORUM Credit Union achieved accuracy levels that far exceeded expectations.

“With Multimodal’s AgentFlow platform, we’ve seen accuracy levels exceed 99% in both document classification and data extraction—far surpassing our original targets.” — Chris Ferguson, Senior Vice President Consumer Lending at FORUM Credit Union

Key results:

Document Classification Accuracy

- 99% accuracy across 62 document packages (15–61 pages each)

- Exceeded FORUM's target of 90%

Data Extraction Precision

- Achieved 99% accuracy across 9 core document types

- Extracted 47+ distinct fields including borrower details, financials, and signatures

- Handled scanned and handwritten formats seamlessly

Automated Decisioning

- Generated explainable loan decisions based on extracted data

- Auto-calculated payout values, reserve amounts, and segmentation codes

- Every decision stored with a full audit rationale

Workflow Integration

- Embedded reviewer workflows with editable override fields

- Live API integration with Temenos, with authentication and error-handling

- Full traceability for compliance and audit

These gains eliminated costly errors, reduced compliance risk, and freed staff from repetitive manual review. With calculations and approvals flowing directly into Temenos, FORUM created a straight-through process that was faster, more transparent, and fully auditable.

The team can now focus on value-added decisions instead of paperwork and scale loan processing without adding headcount.

“What impressed me most is how the solution was designed around our real-world workflows. Our lending team can now focus on value-added decisions rather than paperwork, and we’re positioned to scale loan processing without adding headcount. Multimodal didn’t just deliver technology; they delivered confidence that we can serve our members faster and more reliably. This is the future of lending at FORUM Credit Union.” — Chris Ferguson, Senior Vice President Consumer Lending at FORUM Credit Union

About the customer

FORUM Credit Union is a leading Indiana-based cooperative serving thousands of members with a full range of financial services. Auto lending is a core line of business, making speed, accuracy, and transparency essential to delivering on its member-first mission.

Book a

30-minute demo

Explore how our agentic AI can automate your workflows and boost profitability.

Get answers to all your questions

See how AI Agents work in real time

Learn AgentFlow manages all your agentic workflows

Uncover the best AI use cases for your business

.svg)