Direct Mortgage Cuts Loan Processing Costs by 80% with our AI Agent

200+

types of processed documents

20x

faster application approval process

80%

cost reduction per processed document

"Nobody is doing what we’re doing with [Multimodal], not even close."

Challenge

- Manual mortgage application processing is time-consuming and labor-intensive;

- Non-AI systems can’t efficiently automate this process, as they lack contextual understanding and machine-learning capabilities;

- The mortgage industry is heavily regulated, requiring automation systems, especially AI systems, to be highly accurate and reliable; off-the-shelf models don’t offer that level of reliability.

Solution

- Customization of GPT-3.5, Llama 2, and LightGBM

- Data preparation (cleaning, labeling, validation)

- In-context learning with DMC’s (un)structured documents

- Fine-tuning with DMC’s (un)structured documents

Results

- AI Agents specializing in document classification and data extraction

- 200+ different document types automatically processed

- 20x faster time-to-approval

- 80% cost reduction per processed document

THE PROBLEM

Delays in Loan Processing Frustrate Borrowers and Brokers and Impact Lenders’ Revenue

During the COVID-19 housing market boom, lenders across the mortgage industry struggled to keep pace with skyrocketing loan origination and processing volumes and evolving regulations. Rising interest rates added pressure as borrowers rushed to secure better terms.

However, Direct Mortgage Corporation (DMC) struggled to keep up due to a significant talent gap. There weren’t enough loan officers to manage the workload effectively.

The result? Lengthy loan closing times, missed mortgage lending opportunities, and dissatisfied borrowers. Closing a mortgage in the U.S. typically takes 30 to 60 days. For DMC, repetitive data handling and manual document reviews only worsened the delays.

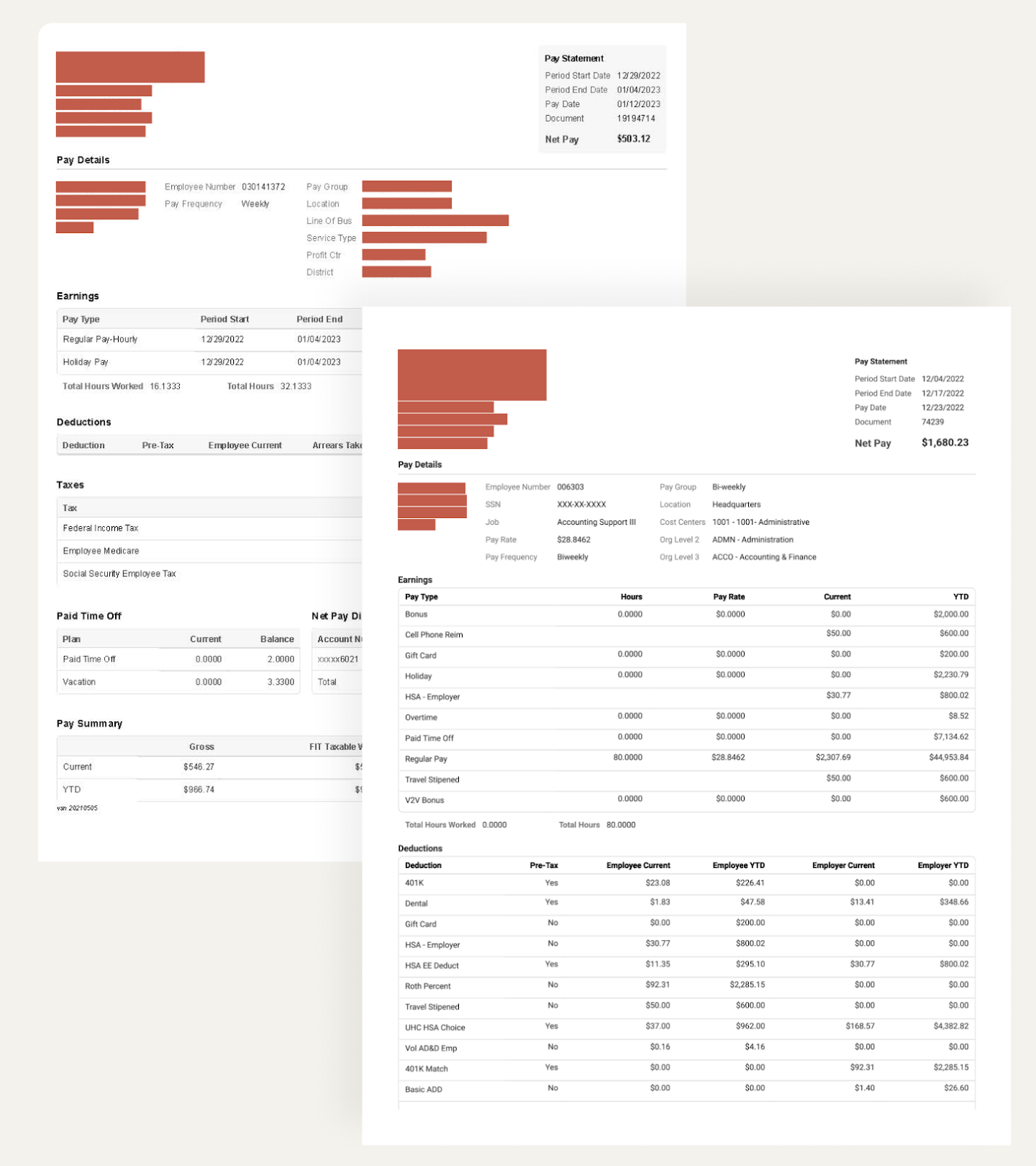

Loan officers had to invest significant manual effort to sift through dozens of documents for each application, including tax forms, bank statements, and credit reports. Mislabeling issues — like pay stubs labeled as bank statements — added further complexity and slowed operations.

These inefficiencies frustrated loan officers and borrowers alike. Loan officers spent too much time on time-consuming tasks, leaving little room for high-value work. Borrowers faced delays and uncertainty, eroding trust and customer satisfaction.

For DMC, the operational bottlenecks led to higher operational costs and lost revenue opportunities.

“I've tried different people with [suitable] skillsets and several different entities. We even built our own programming team. But they could only get so far, and it took forever.” - Jim Beech

By addressing these underlying problems, our solution aimed to streamline the mortgage lending process, improve customer satisfaction, and drive business growth.

THE SOLUTION

Streamlining Loan Processing with AI Agents and Straight-Through Automation

To overcome these challenges, DMC partnered with us to implement AgentFlow, a suite of AI tools powered by generative AI and advanced AI capabilities purpose-built for the mortgage business.

Combining Document AI, Decision AI, and generative AI, Multimodal deployed AI-powered workflows that automated the entire document lifecycle — from classification and extraction to decision-making and compliance checks.

Using a combination of natural language processing, data analysis, and machine learning algorithms, these AI agents were trained on DMC’s internal datasets. This enhanced data collection accuracy and consistency across every workflow, to handle a wide range of mortgage structured and unstructured documents, including:

- Financial account statements

- Pay stubs

- Tax Returns (1040, 1065, 1120, W2, etc.)

- Hazard insurance and title commitments

The solution integrated seamlessly with DMC’s existing systems and third-party tools, ensuring scalability, data security, auditability, and regulatory compliance.

Key innovations included:

- Hybrid Human-AI Collaboration: Manual Processing with Model Assistance (MM) enables human agents to leverage AI tools to assist with document processing. This collaboration increases the speed and accuracy of document handling.

- Automated Document Processing: Using AI tools, bank statements and other documents are processed with minimal human involvement, reducing manual data entry and improving the speed of document verification and compliance checks.

- Scalable Document Workflows: The system supports straight-through processing (STP), where documents are processed end-to-end automatically with minimal need for human review, improving consistency and reducing delays.

- Infrastructure and Data Intelligence: The system leverages S3 storage, Pinecone embeddings, and Datadog monitoring for data analytics, reliability, real-time communication, and full observability, which is crucial for compliance officers managing risk assessment and fair lending practices.

These AI systems address the operational challenges of manual data entry, document verification, and other time-consuming tasks, while empowering mortgage professionals to focus on more strategic, high-value work.

THE RESULTS

DMC Gains Speed, Scalability, and Growth Potential for the Next ReFi Cycle

DMC’s AI-powered mortgage origination system optimizes loan workflows, helps mortgage lenders scale efficiently, and delivers exceptional customer experiences without compromising regulatory compliance, data integrity, or customer satisfaction.

The AI tools and automation we implemented have already produced measurable results that went far beyond automation:

- Faster time-to-approval: Automation accelerated loan decisions up to 20× faster, cutting manual review time by threefold. Borrowers now receive approvals within 24 hours.

- Faster loan closing time: Loan processing dropped from 10 weeks to just 5, enabling borrowers to secure financing sooner and helping lenders close deals faster.

- Queue elimination: Document backlogs dropped from 1,199 in May 2024 to only 4 by January 2025, bringing borrower queues to zero and significantly improving turnaround times.

- High accuracy and operational efficiency: Automation achieved 97–100% straight-through processing accuracy across major document types, including 100% accuracy in categories like verification of employment and title commitments, while reducing operational workload for loan officers and boosting compliance.

- Operational cost reduction: Processing costs per document fell by 80%, minimizing administrative overhead and increasing profitability.

- Throughput growth: Daily processing capacity rose by 16%, reaching an average of 172 documents per day, allowing teams to handle more loans with fewer resources.

- Automated Processing Efficiency: 50% of bank statements are now auto-processed, significantly reducing manual effort. Automated document verification ensures accuracy, detects potentially fraudulent activities, and reduces what once took an hour of manual effort to just 10 minutes.

- Enhanced borrower and broker experience: Borrowers benefit from faster decisions and seamless communication, while brokers can offer quicker, more reliable timelines — helping secure deals before competitors.

- Higher revenue potential: Faster closings enable lenders to capture top borrowers and complete more deals in less time.

With mortgage AI and AI-powered workflows, DMC is positioned to capitalize on future growth. The scalability of the system means DMC can manage increased loan volumes without adding more staff or overtime costs. This gives DMC the ability to:

- Close loans faster and capitalize on rate-driven refinance surges.

- Attract top talent, as a modern, efficient environment appeals to mortgage professionals seeking streamlined platforms.

- Strengthen compliance with regulatory requirements and ensure adherence to fair lending practices even as the business scales.

- Improve decision-making with AI solutions that offer predictive analytics, ensuring that DMC can meet future market demands without disruption.

DMC is now ready for the next refinance boom, with the AI systems enabling them to handle higher volumes, serve specific customer groups more effectively, and maintain operational efficiency without sacrificing customer satisfaction or data integrity.

“We gave [Multimodal] the most difficult form to process, a paystub. That was our test pilot. I couldn’t throw anything more difficult at them than that. And in 30 days, they had it resolved.” - Jim Beech | CEO @ Direct Mortgage Corp.

About Direct Mortgage Corp.

Direct Mortgage Corp. (DMC) is a 29-year veteran in residential mortgage lending, known for its customer-centric approach to building innovative, compliant, and technology-driven solutions. They wanted to streamline their lending operations through automation.

By partnering with us, they received their first working prototype in under a month. DMC implemented AI solutions that blend human expertise and artificial intelligence to revolutionize loan origination.

Currently, DMC leverages Intelligent Automation using our agents, Document AI and Decision AI, to automate data extraction and document classification. This enables them to serve more clients, cut costs, and boost employee satisfaction.

Book a

30-minute demo

Explore how our agentic AI can automate your workflows and boost profitability.

Get answers to all your questions

See how AI Agents work in real time

Learn AgentFlow manages all your agentic workflows

Uncover the best AI use cases for your business

.svg)